Contents

In 2024 so far, premium hair care, value-centric fragrances, body skin care, lip makeup and several other categories have propelled growth.Carlo at Adobe Stock

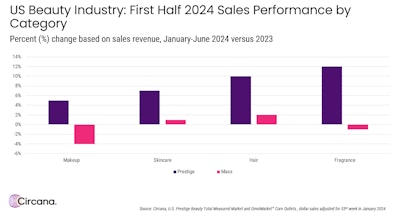

U.S. prestige beauty sales rose 8% in the first half of 2024, totaling $15.3 billion, while mass beauty remained flat year-over-year, totaling $30.4 billion, per new Circana data. Here’s why that is and how this trend trickles down across fragrance, hair care, skin care and color cosmetics.

Based on the latest results, “Circana is forecasting growth in prestige beauty for 2024, with continued growth through 2026, albeit at a slower rate,” says Larissa Jensen, global beauty industry advisor at Circana.

2024’s Beauty Consumers Seek ‘Elevated Value’

Jensen notes, “An accelerated bifurcation is emerging in the beauty industry highlighted by the continued strong growth in prestige in relation to the mass market,” said “Within prestige, drivers of growth point to a similar pattern, indicative of a consumer who is seeking elevated value. Optimizing these opportunities will vary as consumers’ approach to beauty spending differs by demographic–from attitudes and usage, to purchase influencers and shopping preferences.”

She adds, “Total U.S. consumer spending at retail is flat, but beauty growth continues and prestige beauty specifically continues to be one of the fastest growing industries across the general merchandise and CPG markets.”

Jensen concludes, “While consumers may trade down in other areas, within beauty they continue to spend in prestige as the mass market experiences unit sales declines. Interestingly, within the prestige market we see a consumer looking for value though lower-priced brand and product options.”

Prestige Fragrance Leads 2024 Growth

“An accelerated bifurcation is emerging in the beauty industry highlighted by the continued strong growth in prestige in relation to the mass market,” said Larissa Jensen, global beauty industry advisor at Circana.CircanaPrestige fragrance sales grew 12% in the first half of 2024, faster than any other prestige category, and experienced only a nominal decline in mass results. Notably, both lower- and higher-priced prestige fragrances are performing well.

Top fragrance growth engines included:

Power Sells: Eau de Parfums and Parfums

This is not a new phenomenon. In 2023, Circana reported that higher fragrance concentrations such as eau de parfums and parfums gained three share points. These two product types are leading fragrance growth and rising prices.

Small is Big: Mini Sizes/Travel Sizes

This is also not a new phenomenon. Last year, Circana reported that unit sales for mini women’s fragrances grew at five times the rate of other sizes. For the first half of 2024, units sold for mini scents grew at twice the rate of the fragrance category.

Body Sprays Signal Value-seeking

Body mists and sprays, which feature average prices under $25, more than doubled in sales revenue since the first half of 2023. This trend has continued over the last year-plus, driven by Gen Z.

Gen Z Drives Dupes

Fragrance dupes continue to be a Gen Z favorite. A recent Circana analysis noted that scent dupes offer a similar fragrance experience as a luxury or niche brand, but at a fraction of the cost. These lower cost alternatives are more visible and discoverable than ever, thanks to #PerfumeTok and high Gen Z engagement in the fragrance category.

Gen Z is reportedly “twice as likely to be influenced to purchase a scent that is a dupe or inspired by a more expensive scent,” per the Circana analysts, in part because these shoppers believe that lower cost fragrances can be just as good as their more premium counterparts.

In 2024, the dupe culture trend is a “bright spot in the mass fragrance market,” with private label brands growing more than 50% year-over-year. Many are marketed as equivalents to luxury and prestige brands.

Hair Care is Driven by Premiumization in 2024

Hair product sales in the prestige market increased by 10%, based on dollars. Notably, hair products with average prices above $30 grew 3x the rate of lower priced items and now account for 25% of unit sales for the hair care category. That’s a 10% gain of market share in just the last three years.

Mass hair care also experienced the largest growth compared to other categories tracked in the Circana report.

Hair care is also the only category with the majority of its sales coming from ecommerce, per Circana. Sales in that channel are experiencing double-digit growth.

Meanwhile, styling and treatments were the fastest-growing areas of the category. In 2023, Circana reported double-digit growth in most hair styling segments.

Body Care Dominates 2024 Skin Care Sales

Prestige skin care dollar sales increased by 7% in the first half of 2024, leading growth in units sold.

Body skin care is the fastest-growing sector of the overall category, driven by body spray sales, which have grown in the triple digits in the first half of 2024. Double-digit growth has also been seen for body creams, lotions and cleaners.

Per Circana, consumer spending on prestige body products increased by 25% and there are 17% more buyers in this market than there were last year.

Lips & Unique Formats Drive 2024 Makeup Sales

While prestige makeup remains the largest category in the prestige market, its sales grew 5%, slower than the other categories tracked in the Circana report.

Prestige lip segment sales grew in the double-digits, led by balms and oils. Furthermore, lip gloss and liner were top sales gainers in the mass sector. This lip makeup boom is not a new phenomenon, carrying over from 2023.

Other top performers include unique formats such as:

- liquid blushes, sticks and balms

- liquid bronzers

- stick foundations

- stick eye shadows